Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income . Has a progressive income tax system, meaning higher. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). see current federal tax brackets and rates based on your income and filing status. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. a taxpayer's bracket is based on his or her taxable income earned in 2024. Tax brackets determine the tax rate you pay on each portion of your income. current income tax rates and brackets. You pay tax as a percentage of. tax brackets are based on taxable income after all deductions and credits and not gross income or adjusted. Income ranges are adjusted annually for inflation, and as such. which income tax bracket do you fall within? In singapore, there are 12 income tax brackets from ya2024 (2 more.

from www.chegg.com

tax brackets are based on taxable income after all deductions and credits and not gross income or adjusted. Has a progressive income tax system, meaning higher. which income tax bracket do you fall within? The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). In singapore, there are 12 income tax brackets from ya2024 (2 more. see current federal tax brackets and rates based on your income and filing status. You pay tax as a percentage of. current income tax rates and brackets. Income ranges are adjusted annually for inflation, and as such. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024.

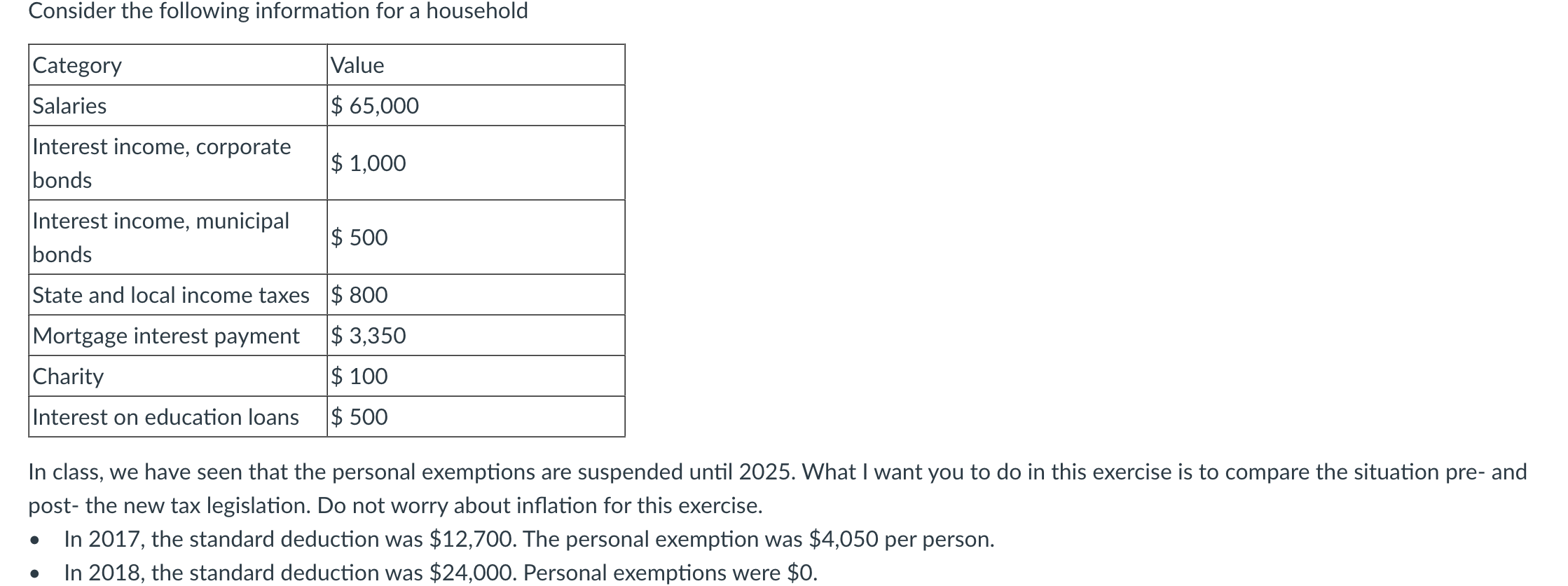

Solved For both years, find the respective tax brackets for

Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income a taxpayer's bracket is based on his or her taxable income earned in 2024. tax brackets are based on taxable income after all deductions and credits and not gross income or adjusted. Tax brackets determine the tax rate you pay on each portion of your income. current income tax rates and brackets. You pay tax as a percentage of. a taxpayer's bracket is based on his or her taxable income earned in 2024. In singapore, there are 12 income tax brackets from ya2024 (2 more. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. see current federal tax brackets and rates based on your income and filing status. which income tax bracket do you fall within? Has a progressive income tax system, meaning higher. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). Income ranges are adjusted annually for inflation, and as such.

From www.njpp.org

Reforming New Jersey’s Tax Would Help Build Shared Prosperity Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income Has a progressive income tax system, meaning higher. current income tax rates and brackets. You pay tax as a percentage of. tax brackets are based on taxable income after all deductions and credits and not gross income or adjusted. a taxpayer's bracket is based on his or her taxable income earned in 2024. see current federal. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From youstaywealthy.com

Medicare IRMAA Brackets 2024 Everything You Need to Know Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income a taxpayer's bracket is based on his or her taxable income earned in 2024. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. In singapore, there are 12 income tax brackets from ya2024 (2 more. current income tax rates and brackets. Has a progressive income tax system,. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From renaqcoralie.pages.dev

Federal Tax Brackets For 2024 Jonie Martynne Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income a taxpayer's bracket is based on his or her taxable income earned in 2024. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. which income tax bracket do you. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From www.youtube.com

Taxation Concepts of (Gross Net Part 1 Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income You pay tax as a percentage of. Has a progressive income tax system, meaning higher. a taxpayer's bracket is based on his or her taxable income earned in 2024. current income tax rates and brackets. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). see current federal tax. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From karenygriselda.pages.dev

Tax Slab 2024 25 Ula Lianna Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income Has a progressive income tax system, meaning higher. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Income ranges are adjusted annually for inflation, and as such. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). current income tax. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From aidanbcaroljean.pages.dev

Medicare Limits 2024 California Emma Norina Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income You pay tax as a percentage of. which income tax bracket do you fall within? Tax brackets determine the tax rate you pay on each portion of your income. Has a progressive income tax system, meaning higher. tax brackets are based on taxable income after all deductions and credits and not gross income or adjusted. Income ranges are. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From imagetou.com

Federal 2023 Tax Rates Image to u Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income a taxpayer's bracket is based on his or her taxable income earned in 2024. Has a progressive income tax system, meaning higher. current income tax rates and brackets. You pay tax as a percentage of. see current federal tax brackets and rates based on your income and filing status. Income ranges are adjusted annually for inflation, and. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From spot.pcc.edu

Taxes Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income which income tax bracket do you fall within? a taxpayer's bracket is based on his or her taxable income earned in 2024. current income tax rates and brackets. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Income ranges are adjusted annually for inflation, and as. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From www.pinterest.com

Are Tax Brackets Based on Gross or Adjusted Gross Tax Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income see current federal tax brackets and rates based on your income and filing status. You pay tax as a percentage of. Has a progressive income tax system, meaning higher. which income tax bracket do you fall within? In singapore, there are 12 income tax brackets from ya2024 (2 more. The federal individual income tax has seven tax rates. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From federalwithholdingtables.net

2021 IRS Tax Brackets Table Federal Withholding Tables 2021 Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). In singapore, there are 12 income tax brackets from ya2024 (2 more. current income tax rates and brackets. see current federal tax brackets and rates based on your income and filing status. Tax brackets determine the tax rate you pay. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From askanydifference.com

Taxable vs Adjusted Gross Difference and Comparison Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income Income ranges are adjusted annually for inflation, and as such. a taxpayer's bracket is based on his or her taxable income earned in 2024. You pay tax as a percentage of. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. The federal individual income tax has seven tax. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From www.chegg.com

Solved For both years, find the respective tax brackets for Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income a taxpayer's bracket is based on his or her taxable income earned in 2024. In singapore, there are 12 income tax brackets from ya2024 (2 more. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. The federal individual income tax has seven tax rates ranging from 10 percent. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From boxden.com

Oct 19 IRS Here are the new tax brackets for 2023 Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income You pay tax as a percentage of. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. which income tax bracket do you fall within? Income ranges are adjusted annually for inflation, and as such. a taxpayer's bracket is based on his or her taxable income earned in. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From www.youtube.com

How To Calculate Tax on Salary with Payslip Example Tax Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income Has a progressive income tax system, meaning higher. a taxpayer's bracket is based on his or her taxable income earned in 2024. which income tax bracket do you fall within? current income tax rates and brackets. Income ranges are adjusted annually for inflation, and as such. to achieve greater progressivity, the top marginal personal income tax. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From www.hotzxgirl.com

Usa Tax Brackets Hot Sex Picture Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income In singapore, there are 12 income tax brackets from ya2024 (2 more. Has a progressive income tax system, meaning higher. a taxpayer's bracket is based on his or her taxable income earned in 2024. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). see current federal tax brackets and. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From www.youtube.com

Taxable and tax liability YouTube Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income Tax brackets determine the tax rate you pay on each portion of your income. a taxpayer's bracket is based on his or her taxable income earned in 2024. You pay tax as a percentage of. which income tax bracket do you fall within? see current federal tax brackets and rates based on your income and filing status.. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From www.pinterest.com

Key Facts You Need to Know About Definitions for Marketplace and Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income In singapore, there are 12 income tax brackets from ya2024 (2 more. a taxpayer's bracket is based on his or her taxable income earned in 2024. Income ranges are adjusted annually for inflation, and as such. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Has a progressive. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.

From lemonwest.weebly.com

Pennsylvania tax brackets 2021 lemonwest Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income current income tax rates and brackets. In singapore, there are 12 income tax brackets from ya2024 (2 more. Tax brackets determine the tax rate you pay on each portion of your income. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. The federal individual income tax has seven. Are Tax Brackets Based On Adjusted Gross Income Or Taxable Income.